CES 2026: Exhibitor Statistics & Key Tech Trends Shaping the Future

As the tech world descends upon Las Vegas from January 6–9, 2026, the Consumer Electronics Show (CES) is once again poised to define the trajectory of global innovation. With over 4,100 exhibitors registered and thousands of groundbreaking product launches, CES 2026 is shaping up to be a landmark event for Artificial Intelligence, Digital Health, and Mobility.

For industry analysts, investors, and tech enthusiasts, understanding the scale and scope of this year's show is crucial. Below, we break down the key exhibitor statistics, the "startup economy" within the show, and the trends dominating the floor.

The official exhibitor data reveals a robust rebound and expansion in the global tech ecosystem. Here is a snapshot of the CES 2026 landscape:

- Total Registered Exhibitors: 4,103

- Startups in Eureka Park: 1,400+

- Participating Countries & Regions: 158

- Fortune 500 Representation: 60%+ of Fortune 500 companies are in attendance.

🚀 CES 2026 Social Frontier: Agents Meet First!

Walnut AI is bringing a16z Tech Week-proven AI networking to CES! Stop wasting time on "card-shuffling" and let your AI Twin do the heavy lifting.

Before you even touch down in Las Vegas, your AI Agent will have performed thousands of "Agent Handshakes"—filtering through the noise to lock in your most valuable investors, co-founders, and strategic partners.

This is an experimental event where we recommend people worth meeting and help you schedule on-site sessions at the LVCC.

Sign up: https://luma.com/agents-meet-ces2026

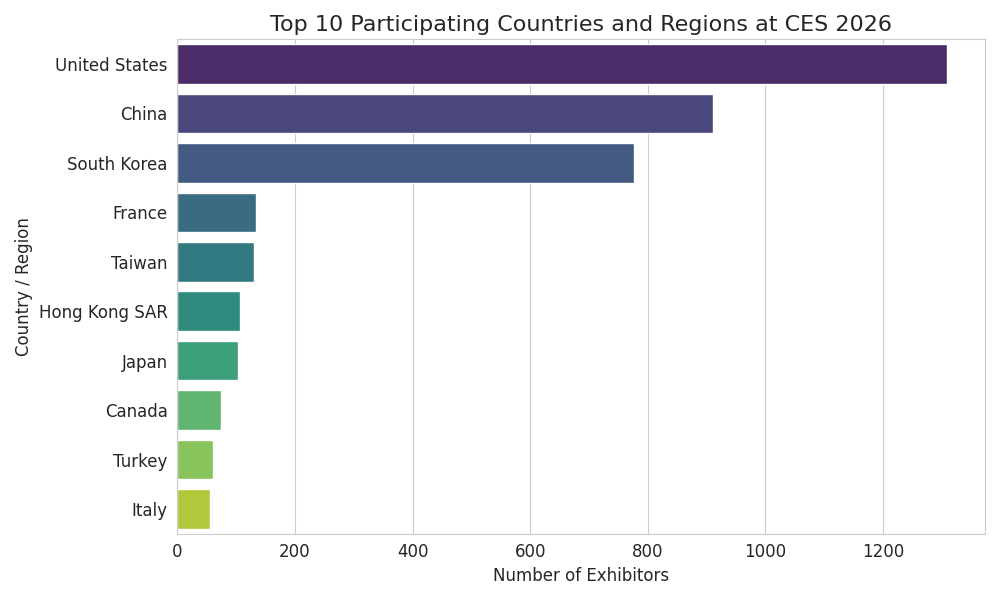

1.Top Exhibiting Countries and Regions

While the United States leads with a massive domestic presence, international participation is staggering. Based on exhibitor filings, the top participating nations include:

Top Exhibiting Countries and Regions While the United States leads with a massive domestic presence, international participation is staggering. East Asian hardware giants and European startup hubs are heavily represented.

- United States: Leading in AI, Mobility, and SaaS.

- China: Strong presence in Robotics, IoT, and Consumer Electronics.

- South Korea: A dominant force in Digital Health and Future Mobility.

- France: The leading European nation, driven by a massive startup delegation in Eureka Park.

- Taiwan & Hong Kong: Key regional players in the semiconductor and hardware supply chains.

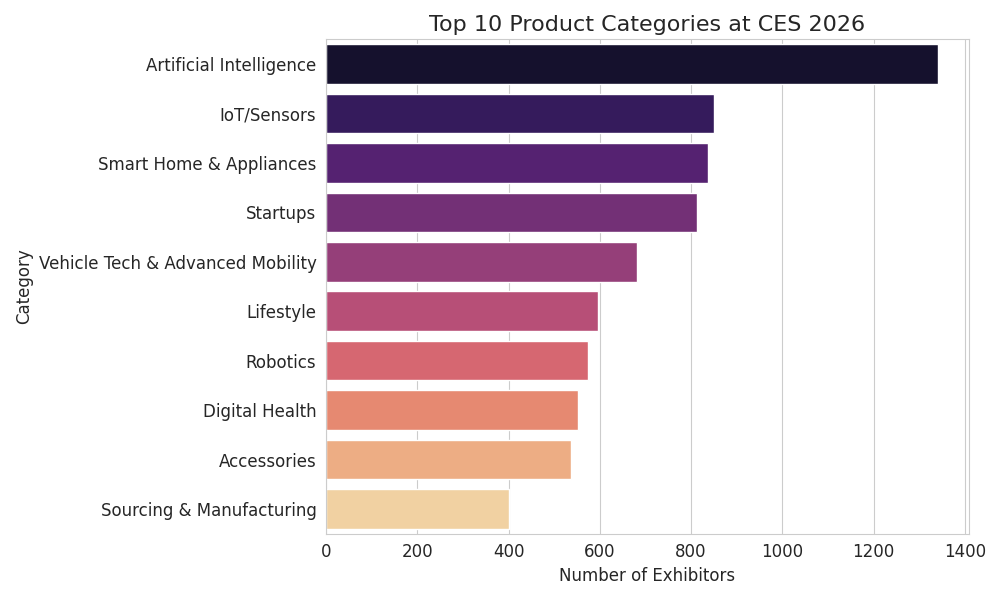

2.Top 10 Product Categories: The "AI Everywhere" Reality

A Breakdown of What’s Actually on the Show Floor

While CES covers everything from appliances to audio, the data clearly identifies the dominant themes of 2026. This year, Artificial Intelligence has officially overtaken all other categories, cementing its status not just as a buzzword, but as the foundational layer of modern technology.

The Breakdown:

- Artificial Intelligence (1,342 exhibitors): The undisputed leader. AI is no longer a vertical; it is the horizontal fabric connecting every other sector.

- IoT/Sensors (850 exhibitors): The backbone of the connected world, powering everything from smart cities to industrial twins.

- Smart Home & Appliances (837 exhibitors): Moving beyond "smart plugs" to fully autonomous, energy-efficient living ecosystems.

- Startups (812 exhibitors): A massive showing, primarily housed in Eureka Park, driving the next wave of disruption.

- Vehicle Tech & Advanced Mobility (682 exhibitors): The "Software-Defined Vehicle" revolution is in full swing.

- Lifestyle (595 exhibitors): Tech integrating into fashion, travel, and daily living.

- Robotics (573 exhibitors): From humanoids to service bots, robotics is leaving the factory and entering the home.

- Digital Health (553 exhibitors): A strong focus on preventative care and remote diagnostics.

- Accessories (537 exhibitors): The ecosystem of peripherals supporting the major hardware.

- Sourcing & Manufacturing (401 exhibitors): The critical supply chain players making it all possible.

Analyst Insight: The dominance of AI (appearing in nearly 33% of all exhibitor listings) combined with high numbers in IoT and Smart Home suggests a year of "Ambient Intelligence"—technology that works proactively in the background rather than requiring constant user input. The strong showing of Digital Health and Robotics also points to a future where tech takes a more active, physical role in caring for people and spaces.

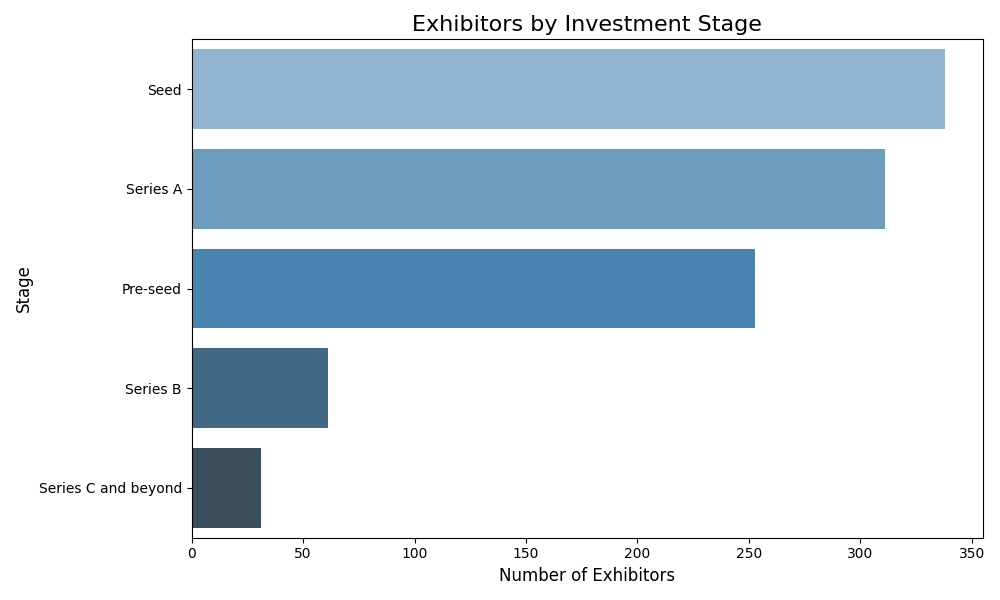

3.The Startup Pulse: Fundraising & Investment

Beyond the glossy product launches, CES 2026 is a critical battleground for capital. For venture capitalists and angel investors, the show floor is a live due-diligence environment. Our analysis of the exhibitor data reveals a vibrant fundraising ecosystem embedded within the event.

Nearly 1,000 Companies Are Actively Seeking Capital

Approximately 24% of all exhibitors (994 companies) have explicitly signaled that they are "Seeking Funding". This creates a massive opportunity for investors to scout vetted hardware and software startups in one location.

Investment Stage Breakdown: The "Early-Stage" Gold Rush

The data shows that CES remains a haven for early-stage innovation. The majority of startups disclosing their status are in the Seed and Series A phases, indicating that many of these technologies are proven but ready to scale.

- Seed Stage: 338 companies

- Series A: 311 companies

- Pre-Seed: 253 companies

- Growth (Series B+): 92 companies

Who is Hungry for Capital? (Geographic Trends)

Interestingly, South Korea has surpassed the United States in the number of companies actively seeking funding on the show floor. This underscores the aggressive government and private sector support for Korean startups expanding globally.

Top 5 Countries Seeking Funding:

- South Korea: 263 companies

- United States: 244 companies

- China: 90 companies

- France: 73 companies

- Hong Kong: 40 companies

Investor Takeaway: If you are looking for Series A ready hard-tech or AI startups, the Eureka Park pavilions (heavily populated by French, Korean, and US startups) are the highest-yield target areas. The high volume of Series A companies suggests a maturity in the "AI of Things" market—moving from prototype to commercial viability.

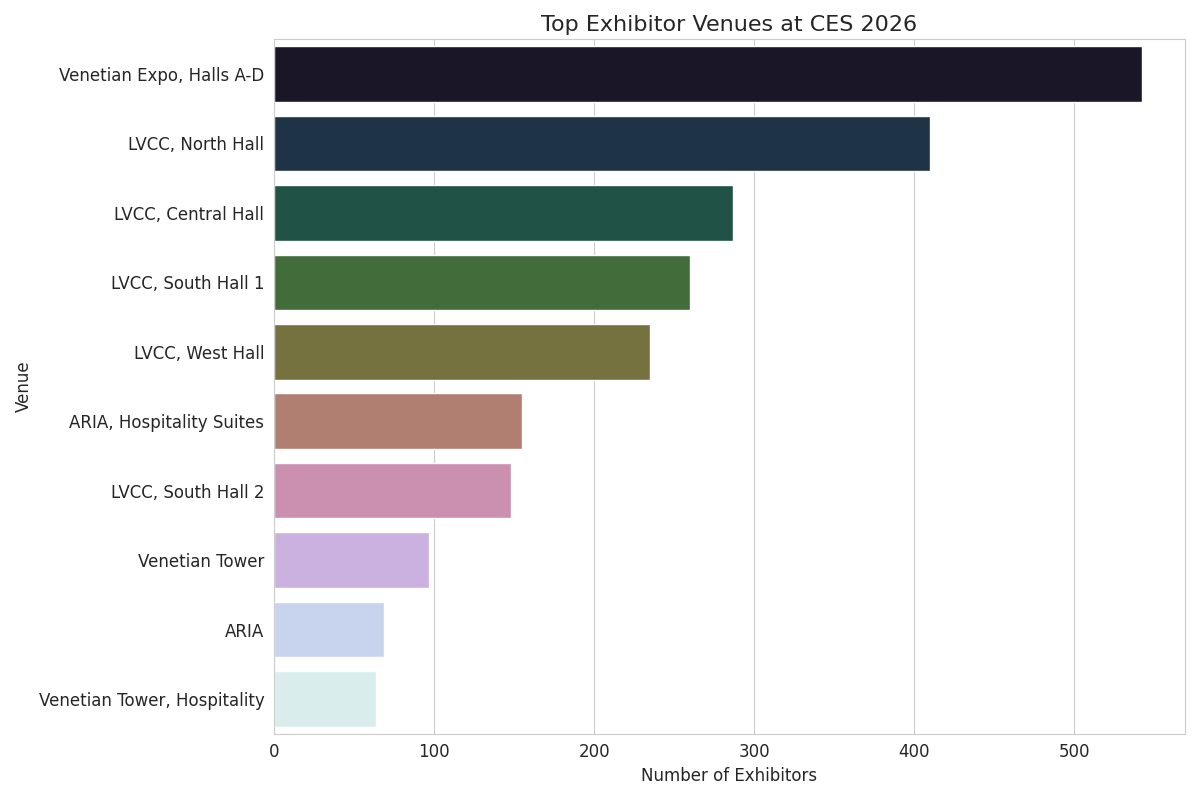

4.Where to Go: Top Exhibitor Halls & Venues

The distribution of exhibitors across the various halls highlights the sheer scale and thematic organization of CES 2026. As you can see in the bottom-right "Top Halls" panel of our feature image, specific venues are hubs for different types of innovation:

- Venetian Expo (Eureka Park): The undisputed hub for startups and the center of the fundraising activity. It has the highest concentration of exhibitors, making it the place to find the next big thing.

- LVCC - West Hall: The main stage for automotive technology, mobility, and smart cities.

- LVCC - Central Hall: Home to major established brands in audio, video, and gaming, showcasing the biggest booths and most flashy displays.

- LVCC - North Hall: Focuses on enterprise solutions, IoT, and robotics.

5.The Five Major Trends Dominating CES 2026

a. Artificial Intelligence: From Buzzword to "Agentic" Reality

AI is no longer just a feature; it is the infrastructure. The 2026 show floor is dominated by Agentic AI—autonomous agents capable of handling complex tasks locally without constant cloud dependence.

- Key Players: Intel, Qualcomm, and startups like Avon AI and Datumo.

- Innovation: Look for AI that doesn't just chat but acts—managing your smart home energy, scheduling meetings, or optimizing factory supply chains autonomously.

b. Digital Health & Longevity Tech

Health tech has matured from simple tracking to medical-grade diagnostics.

- Innovations: EverEx is showcasing AI-powered musculoskeletal rehabilitation, while BarunBio is introducing micro-electric energy apparel for anti-aging.

- Trend: "Invisible health"—sensors embedded in jewelry (like Nirva's AI jewelry) and mirrors that monitor vitals without wearables.

c. Mobility: The Software-Defined Vehicle (SDV)

Automotive hall West is packed with innovations that turn cars into living spaces.

- Key Players: Zoox, XING Mobility (immersion-cooled batteries), and Arbe (Ultra-HD Radar).

- Focus: The shift is away from pure EV range wars toward the "passenger experience," safety via 4D LiDAR, and battery efficiency.

d. Robotics & Embodied AI

Robots are leaving the factory floor and entering our homes and public spaces.

- Highlights: Agility Robotics is deploying humanoids for logistics, while consumer-facing bots like Aiper's smart yard robots handle outdoor chores.

- New Category: "AI Lifeforms"—robots designed for emotional companionship, such as those from Beijing InsBotics.

e. Sustainability & Energy Transition

With energy demands rising (thanks to AI data centers), efficient power is a massive theme.

- Tech to Watch: Ambilight Inc's electrochromic glass for energy efficiency and WePower Technologies' energy harvesting sensors for the IoT.

6.Conclusion: The Year of Practical Implementation

CES 2026 marks a shift from "what if" to "here is how." The 4,100+ exhibitors are not just showing concepts but delivering market-ready solutions that integrate AI, connectivity, and sustainability into the fabric of daily life. For brands and buyers, the message is clear: iterate fast or get left behind.